The world after April 2, 2025

On Thursday, April 3 the world woke up different. Decades of free trade fell under the new rule of protectionism. What’s stunning is that it took one single signature to erase years of treaties and agreements agreed upon and ratified by most countries. The oddest part is that the move had been widely announced and anticipated as a bold nationalistic move aimed at safeguarding jobs and industries of a single country, which already is dominant in the commerce scene. In any event, the so called “free world” did not really exist, as tariffs are -and have been- a common staple. We could, however, argue that the efforts to create a more liberal and intergraded commercial environment has been severely hit as countries will move into a “me first” logic rather than pursuing a global community, and not is commerce alone.

Before and after the signatures, economists, journalists, heads of states and CEOs started to imagine the potentially disastrous effects that economies will be facing for the months (years or decades?) to come. Economists and corporate executives across the board forecasted a decreasing purchasing power ranging between $3’000 and $ 5’000 per US household per year, as tariffs will ultimately be paid by American companies and consumers. Bloomberg Economics estimated an impact of 2.3% on China’s GDP, 1.1% on that of Europe, and up to 2.3% on the US one.

JPMorgan noted that the tariffs would hike taxes on Americans by $660 billion a year, the largest tax increase in recent memory by a longshot. It will cause prices to surge, too, adding 2% to the Consumer Price Index, a measure of US inflation that has struggled to come back down to earth in recent years. Some analysts believe that the maneuver has the ultimate goal of considerably reducing America’s enormous (and constantly rising) public debt, so that it will be possible to reduce corporate taxes, thus making the USA more attractive than ever, and achieving the other goal of re-industrializing a country that for too long exported primarily services. The shock will be exacerbated by plunging consumer and business sentiment and by any retaliation visited upon America as foreign countries potentially impose new tariffs on the United States.

On the other side of the equation the mantra is that “trillions and trillions of dollars” will make America richer and wealthy again, like never in history. The ultimate goal being that of using such new tariffs as a tool aimed at dismantling barriers that have been put into action by several countries, thus rending the world truly free. Maybe so, but the stakes are high, and the move is perceived as a very high-stake gamble that could lead the entire world into a recession. Ideally Americans will be encouraged to buy American, while many foreign companies will relocate to the US.

Then again, perhaps this bold -yet disruptive- move may curb the negative effects that uncontrolled globalization produced, creating not only wealth, but also specific cases of poverty in several communities. Unfortunately, I tend not to trust populistic proclamations that rarely favor the underprivileged. We truly navigate in uncharted waters.

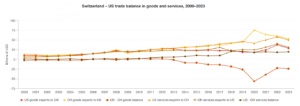

It is not our intention to list the countries that has been heavily targeted, like Switzerland with a 31% reciprocal rate, but the basic assumption was that of targeting economies that have a positive trade balance with the United States.

It’s really too early to tell the impact and if the trade war will be short lived or long lasting. For the time being we have only been able to see the dismal performance of stock markets, especially in the US. It is also too early to tell which countries will retaliate in the weeks to come. On top of the reciprocal tariffs policy, let’s not forget the already announced 25% on vehicle imports. In any event, it would be wiser for most countries not to retaliate and negotiate individually with the White House.

Switching back to us, where does Switzerland stand today, after being hit with a 31% reciprocal tariff, especially the 25% on automakers. Ironically Bern just enacted its revision on the CO2 ordonnance.

A decision which weighs like a millstone on the car market, already put to the test by the marked drop in sales. The first quarter of the year has in fact started badly, if not very badly. “We can say that it is the worst

Source: U.S. Bureau of Economic Analysis

start to the year of the new millennium”, commented the association of importers Auto-Svizzera. Sales, compared to the same period in 2024, have in fact recorded a drop of 8%, with “just” 52,700 new cars placed on the Swiss market. Things are no better in Ticino, where the decline stands at between 8 and 10%, as explained by Marco Doninelli, director of the Swiss Automobile Professional Association (UPSA) Ticino section. Furthermore, he says, “the decline is recorded for all types of vehicles, from diesel to petrol, up to electric, and represents a worse result compared to a year, 2024, which had already been rather difficult”. The situation, in short, is anything but rosy and in the coming months it could even get worse. The icing on the cake is the arrival in Switzerland of the Chinese giant BYD, which will open fifteen branches throughout the country. “Some Chinese brands were already present on the Swiss market, but they were mostly unknown products, which struggled to make their way”, explains Doninelli. “With the arrival of BYD, the story changes: these are high-end products, which I believe will have a particular impact on Tesla, of which they are already direct competitors on a global level. The three models presented in Switzerland, in fact, fall into the same categories as Tesla; therefore, it is presumable that they will take away a share of the market from it”. In general, concludes the director of UPSA, “unlike the Korean and Japanese cars of a few decades ago, the cars produced today by China are very close to the models of European car manufacturers, and could therefore achieve increasingly larger market shares”

Other than the domestic Swiss automobile market, how will the 25% tariff on car imports may affect Switzerland? After all we do not produce nor export cars to America. Correct, but several companies are leaders in auto components, and those too fall into the category. Switzerland hosts several companies that specialize in producing components for the automotive industry. Notable examples include:

Autoneum

Headquartered in Winterthur, Autoneum is a leading manufacturer of vehicle acoustic and thermal insulation systems, supplying major global automobile manufacturers. They already have a significant presence in the US, also achieved with the acquisition of local companies such as Borgers Automotive in April 2023.

Adval Tech Holding

Based in Niederwangen, Adval Tech specializes in high-volume production of metal and plastic components for the automotive sector, including parts for airflow systems, airbags, and lighting systems. They operate in the US via subsidiaries.

EMS-Chemie

Located in Domat/Ems, EMS-Chemie produces high-performance polymers and specialty chemicals used in automotive applications, such as lightweight polymer car parts. EMS-Chemie generates about 50% of its net sales from the automotive market, and their US operations account for 10-15%.

Reishauer

Based in Wallisellen, Reishauer manufactures gear grinding machines essential for producing precision gears used in vehicles. North America accounts for about 30% of their market, but they have a local presence thru Reishauer Corporation in Illinois.

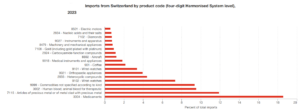

Source: United Nations

As far as the auto industry is concerned Europe has been in a severe crisis, also due to the new green deal policies that opened the door to Asian (mostly Chinese) manufacturers such as BYD. The steep decrease in car production (from 22 million in 2023 to 16 million in 2024) is a clear example.

The EU has also added salt to the open wound when in implemented tariffs on imported aluminum but not on products with aluminum content, resulting in countries manufacturing at home (mainly in Asia) rather than internally.

We must also never forget that the US economy is primarily based on imports, and those will not stop because of higher prices. Therefore, it would not be wise to set up retaliatory measures such as those that the UE is considering. Switzerland is being wise is adopting a dialogue instead of new and immediate tariffs.

Our personal take is that a certain degree of optimism is still to be taken into consideration because both the EU and Switzerland are exporters of products with great added value, such as precision instruments, and that flow of imports will always be present from the US.

As closing remark, if we want to be picky but also to comfort us, we can easily say that companies typically have a harder time in dealing with volatile exchange rates than fixed tariffs even in the midst of the turbulence created by these plunging markets.

Marcello Tedeschi, April 8, 2025