Since the start of the year, Gold has risen by more than 48%, while cryptocurrencies such as Bitcoin and Ethereum have gained 60% and 53%, respectively. On the other hand, major currencies, particularly the US dollar or the Japanese Yen, have fallen by 10% or more in 2025. Long-term government bonds are underperforming, despite falling interest rates. Something appears fundamentally wrong within the financial system.

In recent months, leading financial investors such as Ray Dalio of Bridgewater or Ken Griffin of Citadel, as well as investment banks like JPMorgan Chase & Co. and Citigroup, have proclaimed that the “debasement trade” is the key driver behind the rally in gold and cryptocurrencies.

But what does the "Debasement Trade" actually mean?

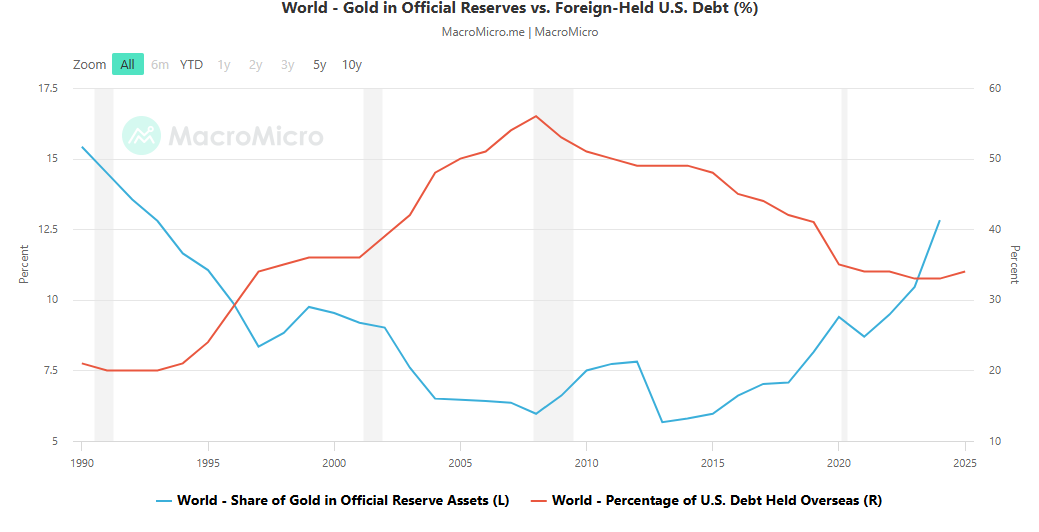

Debasement means erosion and, more broadly, a loss of confidence in fiat currencies and in the safe-haven status of public debt issued by industrialized nations Investors increasingly believe that the dramatic rise in debt burdens, which has accelerated since the Global Financial Crisis of 2008 through quantitative easing programs and prolonged zero or negative interest rate policies, has eroded the long-term value of fiat currencies. Real assets like gold, silver or residential property are in vogue and offer hard value for investors. One of the main reasons gold is performing so strongly is that central banks are reallocating US public debt to gold due to debt inflation.

Source : MacroMicro.me

One could argue that the lack of confidence in currencies and public debt is a lack of confidence in our institutions: governments, parliaments, and judicial systems, the three pillars of democracy.

The roots of debasement

A series of crises — the Global Financial Crisis of 2008, the European sovereign debt crisis, the prolonged disinflation in developed economies fuelled by ultra-cheap goods from China, and the Covid-19 pandemic — have all prompted governments and central banks to flood the global financial system with liquidity through massive quantitative easing and zero-interest-rate policies.

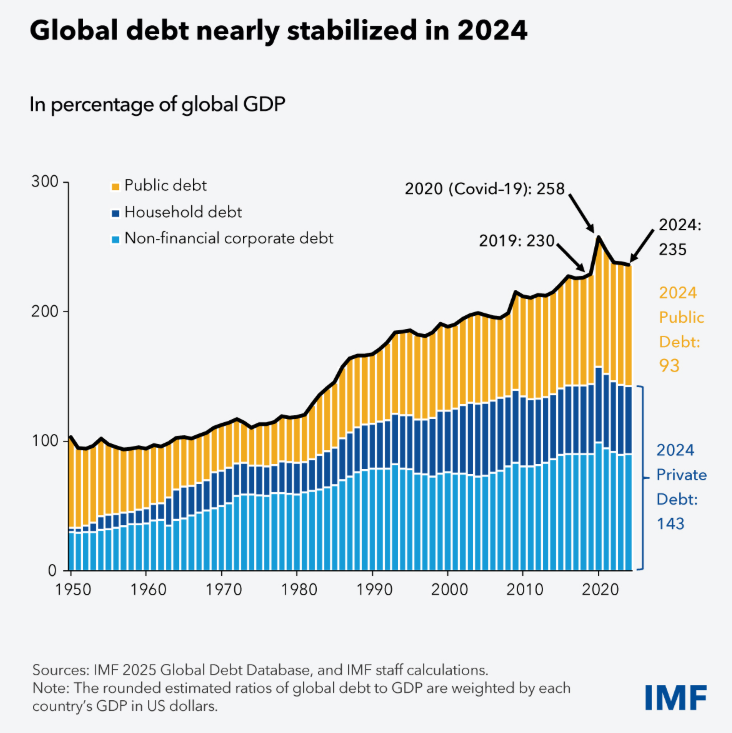

Consequently, fiscal deficits exceeding 6% of GDP per year, far above the traditional 3% benchmark, have become the new normal. Meanwhile, global debt has soared to record highs, as highlighted by the latest IMF Global Debt Database, revealing the deep structural imbalances now embedded in the world economy.

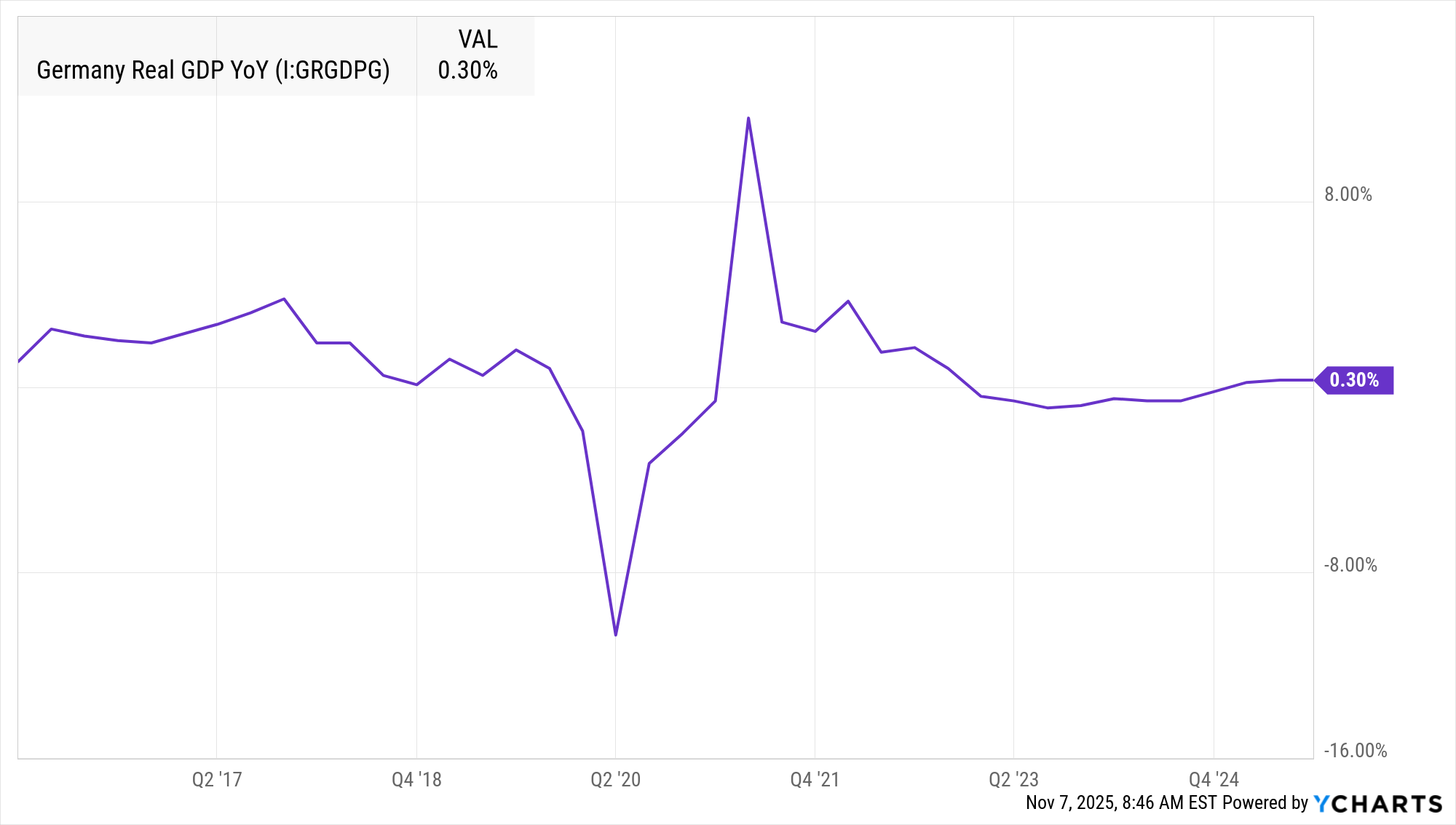

The war in Ukraine and the growing geopolitical threat from Russia — who is suspected to be behind the sabotage of the Danish and the Munich airport last September, which paralyzed the air traffic for more than a day — have further undermined confidence across Europe. At the same time, Germany’s stagnating economy, weighed down by a declining automotive sector and effectively sliding into recession, has eroded trust among European households and investors in the region’s economic outlook

Source : Ycharts.com

Restoring confidence and defending democracy

As described above, the “Debasement Trade” ultimately reflects a loss of confidence, not only in currencies, but in institutions themselves. To preserve democracy, Europe urgently needs strong and credible leadership: leaders capable of convincing their citizens through clear, transparent, and pragmatic programs, and of restoring confidence in the face of the rising influence of autocratic blocs such as China and Russia, as well as the increasingly autocratic tendencies emerging in the United States.

Strong leadership is required at all levels in Europe, from national governments to the European Commission. To rebuild trust and strengthen the continent’s democratic foundations, the following strategic priorities must be urgently addressed:

– Bureaucracy;

– Uncontrolled migration;

– United military defence;

– Centralised budget and fiscal policy;

– Strategic economy programs in technology and bioscience.

If Europe succeeds in addressing these challenges, it will once again become a respected and influential power, recognized both in the East and the West for its stability, unity, and vision.

Gian Heim RESCAD SA, November 2025