MSCI World: how did it change throughout the years. Is it still relevant?

During the last 25 years the shift from active towards passive asset management is perhaps the main megatrend in the financial industry. That shift has been fueled by creation of a multitude of different Indexed ETF’s, funds or Derivatives which replicate indices in all asset classes.

Another driver for passive management came from the consultant and advisory industry, which helps to manage assets for institutional investors. In Europe, one of the most popular trends was to shift specific equity portfolios for US, Europe, Japan to a one global portfolio approach according to the MSCI World Index. In 2005 the MSCI World Index was a broad and diversified Equity Index form a geographical and from a sectorial standpoint (see chart #2 below). Thanks to new investment solutions like indexed ETF and funds, investors invested in an easy and pragmatic way in global equities. In addition to that, this new investment solutions are less expensive than active asset management.

Source: Rescad / LSEG

Hence, for Swiss institutional investors a well-diversified equity portfolio, replicated) in an easy way by an indexed investment fund, was a great benefit, due to the fact that the high concentration and dependency of 6 listed companies in their home markets like Nestlé, Novartis, Roche, ABB, UBS and Zurich represents an ongoing issue for pension plans and other investors. But what about the situation of today? Since the Great Financial and the Covid 19 crisis, we can observe big shifts in the MSCI World Index in terms of regions and in terms of sectors. Today the MSCI World index is very much dependent on the so called magnificent 7. The big US tech and communication services stocks like Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla. Today the technologies/communication service sector represents almost 25% and the US region represents slightly over 71% in the MSCI World Index. In 2000 the same index represented 12-13% in technology/communication services, and about 55% in the USA.

Performances, as the following graph very well shows, have certainly been great, but many investors are probably not fully aware of the extremely high concentration of US stocks present on the index today, as well as the important weight that just a limited number of stocks represents.

Source: Rescad / LSEG

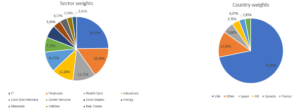

As per more specific weights of the index, the following charts may further give a picture of the current distribution of the Index:

Source: Rescad / LSEG

Summary

The MSCI World Index has evolved from a basic measure of developed markets to a complex, widely used benchmark reflecting major global trends. The index today captures the impact of technological advancements, global economic shifts, and rising interest in ESG, serving as a critical tool for global asset allocation and performance measurement.

Our thoughts

The very broad nature of the MSCI World Index made it a favorite benchmark from its inception to the present days. No argument there. However, we must consider that its diversification is very skewed towards North America, and with the first 10 companies (Microsoft, Apple, Nvidia, Amazon, Meta, Alphabet, Eli Lilly, Broadcom, JP Morgan Chase and Berkshire Hathaway) representing 22.23%, most of which in the new technology industry. We therefore pondered if it is really a reliable benchmark in specific circumstances, such as an investment fund where a limited number of those shares are present.

The question we have been posing to ourself is whether it should be more appropriate to use more specific and narrow indexes for each asset group (Swiss stocks, European or North American), and eventually creating a more ad-hoc reference. This more regional approach will, however, result in better diversification but not better relative performance compared to the MSCI World Index.

Therefore, today’s argument of a broad and well diversified portfolio, in replicating the MSCI World Index, seems not anymore to be an argument in the future.

Finally, just to provide an additional historical context, the following is an overview of its evolution throughout the years since its creation:

- Origins and Foundation (1969-1980s)

The Morgan Stanley Capital International World Index was launched in 1969 to provide a comprehensive measure of global equity markets. Initially, it included companies from developed

markets only. With the rise of globalization and international investing, the Index gained popularity among institutional investors. As trade barriers decreased, it began to be used for global asset allocation.

- Expansion and Market Relevance (1990s)

The index expanded and adjusted country weights to better reflect the economic importance of various developed countries. During this period, Japan held a significant portion of the index due to its economic prominence.: The rise of technological stocks. The boom significantly impacted the index composition, with technology stocks driving returns. By this time, the index covered over 1,500 companies across developed markets.

- Post-Dot-com Crash and Financial Crisis (2000-2010)

After the dot-com bubble burst, tech-heavy indices, including the MSCI World, saw a significant downturn. Many technology firms lost considerable market value, impacting the index. The global financial crisis led to a sharp decline of the index, reflecting the downturn in global equity markets, especially within financial sectors.

- Recovery and Globalization (2010-2020)

As global economies recovered, the MSCI World Index rebounded and reached new highs. U.S. stocks became increasingly dominant, with tech giants like Apple, Microsoft, and Amazon contributing significantly. In 2018 the MSCI made adjustments to enhance transparency and improve how companies were categorized, introducing the Global Industry Classification Standard (GICS) updates, adding sectors like “Communication Services”, that also includes technology. Increasing investor demand for Environmental, Social, and Governance (ESG) metrics led MSCI to introduce ESG-weighted versions of the World Index to cater to this shift.

- Recent Trends and Innovations (2020-Present)

The global market upheaval caused by COVID-19 in 2020 led to a sharp initial decline in the MSCI World Index, but aggressive stimulus measures helped fuel a strong recovery. The 2020s have seen an even stronger emphasis on technology stocks and ESG factors. Tech stocks now make up a significant portion of the index as the capitalization has skyrocketed, especially in the post Covid period. The U.S. has become more dominant within the index, while European stocks have declined in relative weight.

Gian Heim, November 5, 2024