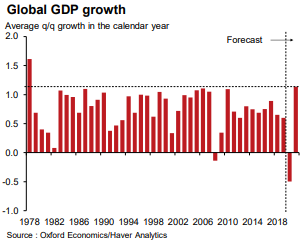

Exactly one year from the beginning of the pandemic crisis (see April 2020 article), it is quite normal to now analyze the issues that concern the possible scenario of the post-pandemic world. As expected, buoyed by Covid-19 vaccines, we think the pace of global GDP growth in 2021 will be extremely fast, the fastest we haven’t seen in years. But for many it won’t feel much like a boom. Instead, the global recovery is set to be uneven, dictated by three key themes.

- Vaccine winners and losers. We anticipate a sustained relaxation of restrictions in some advanced economies around late spring, triggering a mid-year mini boom. Vaccine rollouts in emerging markets will however generally be slower. Actually, the most recent cases setback that hit India is cause of great concern the entire planet as the new strain might be resistant to the vaccines today in place. While vaccines will inevitably help travel and tourism, the transition may be slow. Long-haul travel will recover more slowly than domestic and short haul.

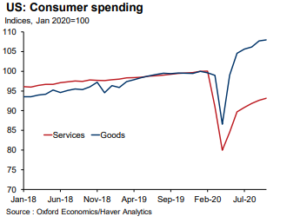

- Industry will be a bright spot. Near-term prospects seem favorable as the sector continues to respond to pent-up demand and rebuilds inventories. But the second half of 2021 may prove tougher as these supports begin to fade, and consumers refocus their spending on services. Sticking with industry, despite considerable spare capacity, stronger capital spending could provide some upside surprises. The pandemic has accelerated structural shifts that are likely to trigger greater spending by the sectoral winners of 2020, such as distribution. Meanwhile, the trauma of lockdowns may encourage firms to adopt more labor-saving technologies to limit any future disruption from social distancing.

- The growth baton is passing from the public sector to the private. This will mark part of the transition to normal, but it won’t be seamless. Past mistakes in rapidly moving to austerity won’t be repeated, but policy will be uncoordinated globally and the risk of governments doing too little outweighs the risk of them doing too much. Consequently, we’re still skeptical that underlying inflation will surge next year.

Theme 1: Vaccine winners and losers

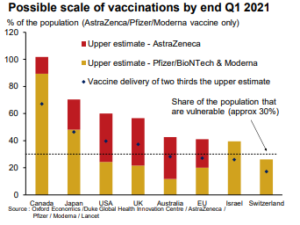

One of the biggest factors determining the strength of next year’s economic recovery will be vaccination progress. Many Advanced Economies may be able to vaccinate a high enough share of the vulnerable population to begin a meaningful and sustained relaxation of restrictions around March/April. This is conditional on the Pfizer/BioNTech, Moderna, and Oxford/AstraZeneca vaccines gaining speedy approval and production proceeding broadly as planned.

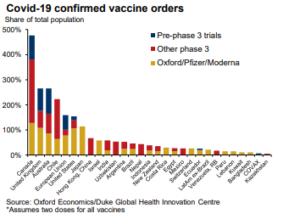

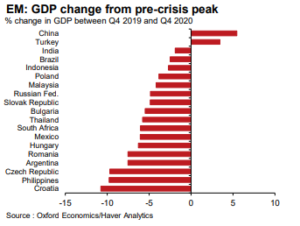

In Emerging Markets, vaccine rollouts will be patchier and generally slower. Many Eastern European EU members will benefit from EU vaccine procurement. Elsewhere, some Emerging Markets, such as India, Brazil, and Indonesia, have pre-ordered vaccines, or held trials in exchange for future vaccine supplies, potentially leaving them with enough vaccine to inoculate the most vulnerable.

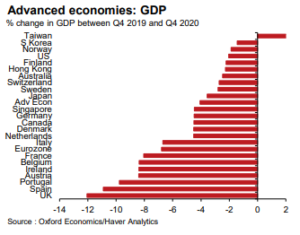

But China and Russia produce a large share of Emerging Markets vaccine pre-orders, which require further testing before being approved. This points to a slower rollout than in Advanced Economies. The biggest winners will be the economies that have suffered the most severe restrictions in containing Covid-19. A vaccine will thus allow a larger unwinding of restrictions and perhaps bigger reductions in voluntary social distancing. In the Advanced Economies, the UK and Spain have both recorded large falls in GDP and had persistently weak mobility, suggesting they may gain more than most. As with the Advanced Economies, the Emerging Markets that have seen particularly sharp drops in activity and major disruption this year look set for the biggest gains.

At the other extreme lie countries, such as China, South Korea, Taiwan, and Vietnam, that have contained the virus without imposing blunt national restrictions. While the vaccine will provide a boost to some forms of ‘social spending’, the pickup is likely to be more muted than elsewhere. The other relatively poor performers will be those with limited or no access to initial vaccine supplies, or that lack the infrastructure to deliver a vaccine speedily to the most at-risk groups. These countries are likely to be poorer and smaller EMs that account for only a small share of global GDP. Programs such as COVAX should help some of them gain access to vaccine supplies.

Theme 2: Industry will be a bright spot

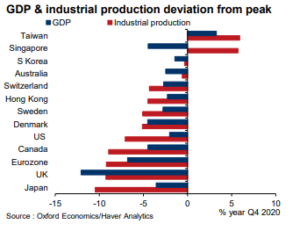

The industrial sector has been widely regarded as showing more resilience than the wider economy, but strikingly in most Advanced Economies industrial production is expected to be even further ahead of pre-crisis levels than overall GDP by the end of 2020.

There are several reasons why industry may fare well in early 2021. First, we think continued robust production will be needed to meet the surge in demand for some products and the release of pent-up demand after lockdown, which has led to shortages of some goods. Second, although global supply chains have proved to be more robust than many feared, container shipping has been hugely disrupted by events in 2020, resulting in a surge in shipping prices and widespread logistical issues. Both factors have resulted in production recovering by less than orders, triggering a reduction in inventories. Waning disruption and a rebuilding of inventories point to production expanding more quickly than orders in H1. Third, although reducing restrictions on activity will see households re-orientate spending back toward services, in the short-term goods spending is likely to continue to

perform well, benefitting industry. And the reopening of parts of the service sector will benefit some industrial sector too. For example, bringing cruise ships and aircraft back into service will lead to increased demand for replacement parts and material for refits. More generally, the reopening of the economy will support the recovery and employment, so even if industries share of the economy shrinks a bit this may be offset by the pie becoming larger Given the calls preceding the pandemic for greater government investment, the second half of 2021 could see governments turn their focus to upgrading infrastructure and greening the economy, boosting both construction and industry.

Theme 3: Passing on the baton

Policymakers deserve some credit for acting quickly during the pandemic and providing large levels of policy support. But we think the next phase – passing the growth baton back to the private sector– will be much more challenging and is unlikely to be seamless.

We agree with the IMF and others that policymakers should err on the side of providing too much stimulus rather than too little. Economies are particularly vulnerable to recession in the early stages of a recovery. How concerned should we be about too much policy tightening in 2021? We see little chance of a major tightening by central banks. In the advanced economies in particular a sustained and strong rise in core inflation looks unlikely. Given that the past decade has seen too little inflation, a faster-than-expected rise in inflation wouldn’t be an immediate cause for alarm. Meanwhile, a weaker US dollar is likely to reduce any pressure on Emerging Markets to raise interest rates. While we are skeptical that governments will go down the road of full-blown austerity and push their economies back into recession, an overly conservative fiscal response may prompt bumpy and uneven growth, increasing the potential scale of scarring in some economies. Booming growth, but it may not feel that way the three themes we’ve identified will be keys to the speed and scale of the recovery globally next year. While we expect the recovery will be strong by historical standards, for many it won’t feel that way and there may be bumps and volatility ahead. Even if the economy grows in line with our estimates, Covid will leave lasting scars that will take years to heal fully.

Marcello Tedeschi, May 3, 2021